Executive Summary

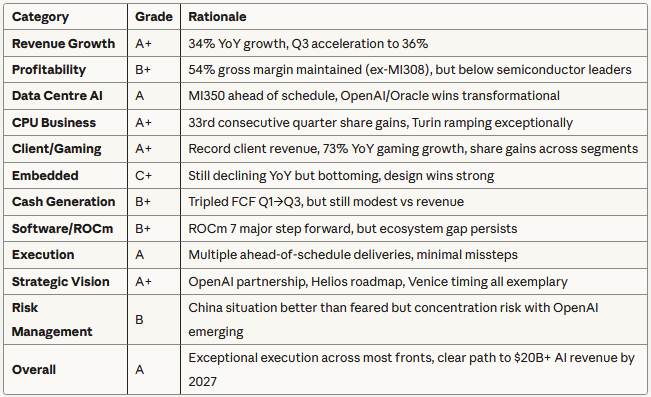

AMD and Broadcom both delivered exceptional Q3 2025 results, with AMD demonstrating accelerating momentum across its diversified portfolio whilst Broadcom maintained its position as the premier AI infrastructure provider with industry-leading profitability. AMD’s Q3 represented a decisive inflection point: record $9.2 billion revenue (up 36% YoY), successful MI350 series ramp offsetting the MI308 China headwinds, and transformational partnerships with OpenAI (6 gigawatts) and Oracle (50,000 GPUs) that validate its competitive positioning for 2026’s MI450/Helios launch. Broadcom continued its relentless execution with $16.0 billion revenue (up 22% YoY), 67% EBITDA margin, and accelerating AI revenue growth to $5.2 billion (up 63% YoY), demonstrating the sustainability of its hyperscale AI networking and custom accelerator dominance. The Q1-Q2-Q3 progression reveals contrasting narratives: AMD navigating regulatory turbulence whilst building towards a multi-year AI inflection, versus Broadcom’s consistent, predictable wealth generation for shareholders through exceptional cash conversion and capital returns.

Three-Quarter Revenue Trajectory Analysis

AMD’s Revenue Evolution (Q1→Q2→Q3 2025)

Q1 2025: $7.4 billion (+36% YoY, +3% QoQ) Q2 2025: $7.7 billion (+32% YoY, +3% QoQ) Q3 2025: $9.2 billion (+36% YoY…