The Federal Reserve (Fed) cut interest rates by 25 basis points as expected and announced the end of its balance sheet reduction plan, but Chair Powell emphasized that “whether to cut rates in December is far from a foregone conclusion,” dousing market optimism. This statement triggered a surge in US Treasury yields, mixed performance in US stocks, with tech stocks supported by Nvidia reaching new highs. Bitcoin and Ethereum faced pressure simultaneously, with investor sentiment remaining cautious.

Fed Slows Pace of Rate Cuts: Halts Balance Sheet Reduction, Remains Cautious in Tone

The Federal Reserve announced a 25 basis point (0.25%) rate cut at its interest rate decision meeting this morning, marking the second rate cut in 2025, and will terminate quantitative tightening starting in December, ending the asset contraction cycle that began in 2022.

However, Chair Powell threw cold water on the market right at the start of the press conference: “A further reduction in the policy rate at the December meeting is not a forgone conclusion — far from it.”

These words interrupted the market’s expectations over the past month for a shift toward long-term rate cuts, and also indicate that the Fed remains cautious in its observations of the economy and inflation. Interest rate swap markets show that the probability of another rate cut in December has dropped from nearly 100% to about 60%.

Internal Fed Divisions Widen: From Opposing Rate Cuts to Cutting by 50 Basis Points?

The decision passed with a 10–2 vote, with one member arguing “no rate cut should be made,” and another supporting a “50 basis point cut.” This is the most evident policy divergence in five years, alerting the market to differing internal assessments of inflation and labor market risks.

Media outlet The Kobeissi Letter pointed out that Fed decisions in the past were almost always unanimous, and this break from tradition echoes Chair Powell’s statement about “December uncertainty.”

US Stock Market Volatile, Nvidia Props Up Tech Stocks to Become First Company with $5 Trillion Market Cap

The market followed Powell’s remarks closely, leading to volatile US stock movements. Meanwhile, Nvidia (NVIDIA) shares surged 3%, pushing its market cap past $5 trillion, marking the first such milestone in global corporate history. TSMC’s ADR rose 1.2% in tandem.

The US Treasury market experienced sharp fluctuations, with the 10-year yield rising to 4.056%, the largest single-day increase since July.

Currently, market focus is shifting to the anticipated Trump-Xi meeting today, with expectations that progress in US-China negotiations will become the next trigger for volatility.

Crypto Market Faces Pressure in Tandem: BTC, ETH Stabilize but Confidence Lacking

Bitcoin (BTC) and Ethereum (ETH) saw short-term declines of 2.3% and 4.2% respectively after the Fed meeting, and have since stabilized slightly.

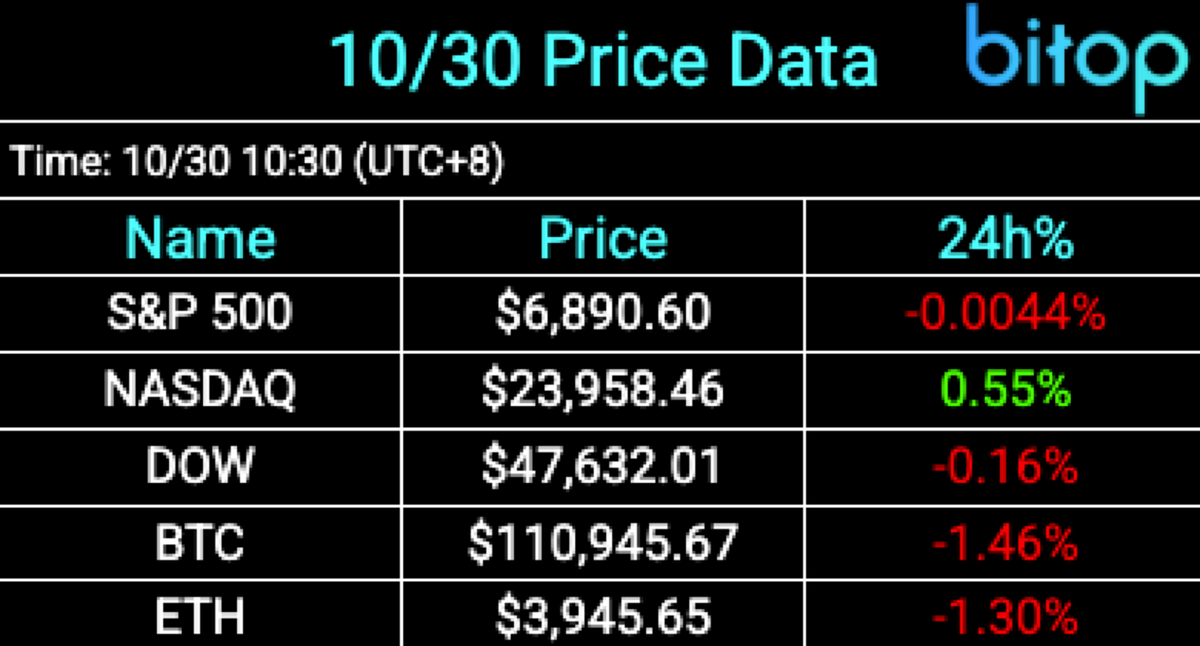

Bitcoin briefly dropped below $110,000 to $109,200 after the announcement, and although it rebounded, it faces the risk of a second dip, temporarily reporting at $110,945 as of press time.

Ethereum fell below $3,900 to $3,840 yesterday, later closing higher at $3,902, and is temporarily reporting at $3,945 at the time of writing.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.