Industry Obs.

“Mini-dramas look like TikToks until you tap ‘unlock’ and realize a whole Candy-Crush economy is hiding underneath.”

— a16z media memo, April 2025

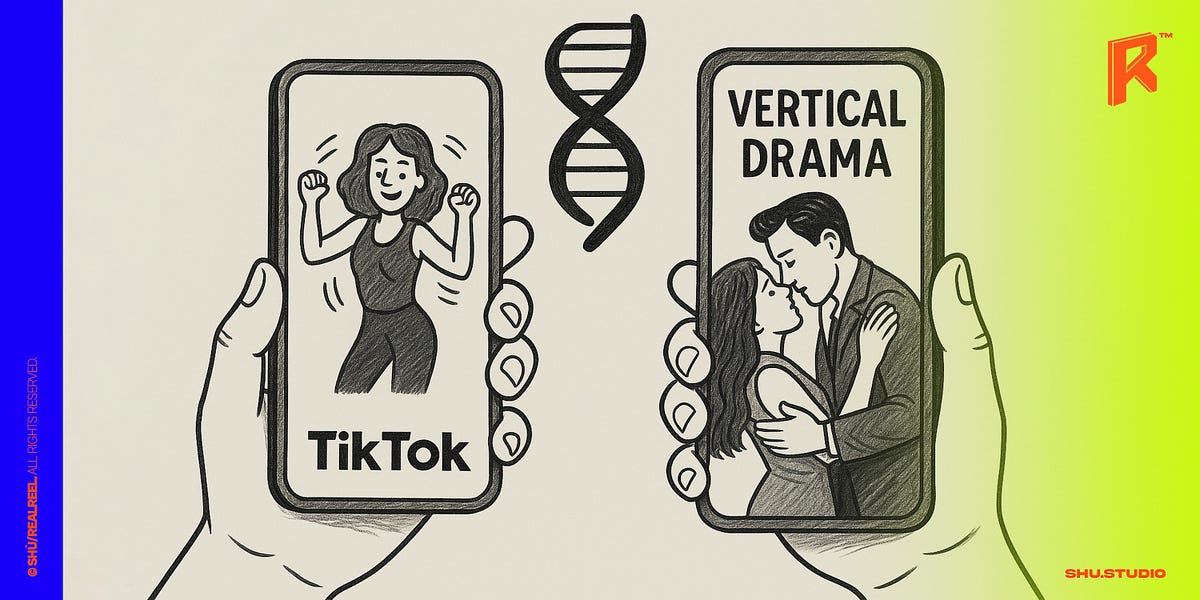

Vertical dramas share a 9∶16 frame with TikTok, but that’s where the overlap ends. They’re season-length stories, monetized by coins AND ads, stitched together in algorithmic writers’ rooms, and their unit economics already rival casual games. Mislabeling them as “clips” blinds Hollywood to the format’s narrative power and financial upside.

Same Phone, Different DNA

TikTok is built for endless scrolling, while vertical drama is engineered as an appointment. A TikTok short lives and dies on a single gag or dance; a vertical-drama episode is a one-minute cliff-hanger designed to push the viewer straight into the next chapter. A full season clocks in at sixty to eighty episodes, roughly the length of a feature film, yet production costs hover at only one to two hundreds thousand dollars.

In other words, the business model is closer to Candy Crush than to social video.

The Candy-Crush Economics of Storytelling

Because every minute and half-long chapter ends on a literal freeze-frame, emotion converts directly into micro-transactions. ReelShort leads the field: its average daily spend per active user already outperforms many mid-tier mobile games, and across 215 U.S. drama apps consumers now pour more than one hundred million dollars a month into coin bundles.

At three to forty cents per unlock the psychological friction is almost zero, yet a single eighty-episode binge can net twenty dollars per paying user, roughly Disney+’s annual ARPU.

The Seven-Day Story Factory

China calls the pipeline “影视工业化 2.0” (Film and Television Industrialization 2.0). A first draft receives an AI beat-sheet pass in six hours; pre-visualization and casting lock on day one; crews shoot seventy pages in five days; and post-production plus thumbnail A/B testing wrap within forty-eight hours of the final shot.

Myths and Realities

The most common misconception is that micro-dramas are just user-generated fluff, but nothing about Equity actors remaking Pride & Prejudice vertically on ReelShort feels amateur.

Advertisers are not footing the bill: ninety percent of top-grossing apps lean on in-app purchases, not pre-roll. And while some indie producers hope union rules won’t apply, SAG-AFTRA’s New Media office is already fielding classification queries, signaling that real labor negotiations are inevitable.

Where Hollywood Could Fumble

The very strengths of the model, speed and data, could turn into liabilities.

If studios treat vertical sets like influencer shoots, a fresh guild showdown will arrive even faster than the 2023 strike cycle.

Meanwhile, audiences are already showing signs of fatigue toward billionaire-werewolf soap loops, and over-reliance on Chinese web-literary tropes risks both cultural mismatch and FTC scrutiny.

The Opportunity Edge

Right now the sector is still a data-first tech play, but the next winners will be story-native companies that graft professional, guild-savvy show runners onto the forty-eight-hour production line.

Creators who can blend audience telemetry with genre-diverse, globally licensable characters will transform “algorithmic content” into “content-native algorithms” and secure a moat that metrics alone cannot provide.